Liberation Day

Epistemic Status: Thinking out loud. Highly speculative spitballing from a person with no formal econ degree. Strong opinions weakly held.

Some thoughts as I freak out on day two of the market plummeting in response to these incoming tariffs:

I. Changing Rich, Changing Norms

There’s a fundamental shift going on in how billionaires etc interface with the government, and honestly, reality at large. The old era of backroom lobbying and regulatory capture that at least kinda tried to appear subtle is giving way to a much more overt and personally involved oligarch-style grift. Expect much more blatantness re protectionist tariffs, contract awardance favoritism, etc. As a result, some market movement may be more crude, more simple, and more localized to single companies that are treated well, or treated poorly if they draw the ire of the administration [1].

BigCorps are experimenting [2]. Take that wave of DEI rollbacks: big, serious companies made some extremely overt maneuvers that are a 180 from their previous stances, and would have, in years past, been seen as too unpalatable to implement in broad daylight. More companies followed suit. We are in a highly transitional period where not only are existing norms unusually plastic, but everyone knows that everyone knows that existing norms are plastic. So there’s a race to both set and discover whatever the new rules are. These companies aren’t stupid: now is the time to be naughty in the ways you want normalized.

II. Rerouting The Global Economy

The shift of other nations to trade with each other, to trade around America, will open a lot of doors. As in eg Brazil, tariffs will encourage an artificial economy that exists only within the borders of America, where domestically produced items of lesser quality dominate because they’re priced competitively relative to superior but tariffed imports. In other words, there are going to be two significant redistributions of wealth and trade profits:

The foreign recipients of trade that is routed away from America

Keep an eye out: who is ready now? Non-US fighter jets went from knock-off beanie baby status to a very attractive deal in no time flat. This is representative: when the top dog disappears, today’s second place is tomorrow’s first mover advantage. What are key exports from America with the least demand elasticity – exports that will need to be bought from someplace else? For each of these, what is that someplace else?

Many of these winners are fleeting. Some because newly motivated entrants will disrupt incumbent businesses. Some because they could only exist in the momentary climate created by money flying around intensely, desperate for a place to land. Remember when the $ZOOM stock absolutely exploded, and it wasn’t even for the right company? Remember Peloton? There’s gonna be a shitload of those. [3]

The domestic producers of goods that are newly “competitive”

Now that the thumb’s on the scale, that is. As above: who is ready now? What categories of goods are currently serviced by china, that have existing american substitutes which (critically) are not comprised of more chinese parts on the inside [4]. That “on the inside” part points out less obvious short opportunities, too: who seems American made but is about to get walloped on their BOM? Otherwise, back to basics here. Steel mills. Raw materials. There’s a reason that Home Depot was one of the only things I saw today that was any shade of green.

III. The Duct Tape Tree House

The US debt situation will dramatically worsen. I am not familiar with the details of the national debt AT ALL, to be frank. And that feels like it follows naturally, given how the national debt is presented in the zeitgeist: as this abstract thing that need not be worried about, that will be somehow made irrelevant and financially engineered away as part of some equally opaque spending bill in the medium-near future. It makes sense to me that repeatedly behaving this way would work for awhile, leveraging with America’s rapport, at the expense of becoming far less sustainable, and incurring a harsher comedown when reconciliation eventually arrives. It also makes sense that we would behave as though this were surely not the very last time we can play that game, every time, despite mounting signals that the opposite is true, until something big and silly and dumb happens.

HOWEVER —

I also think we’re quite good at inventing new abstractions to delay this reckoning, and while the credibility we’re leveraging is currently speedrunning the road to zero, this administration is perhaps the best possible environment for those excuses to continue to thrive. Nonsensical spending bills and blatantly flawed thinking that wouldn’t fly in past administrations have much better odds in this environment, which somewhat increases our runway.

IV. How Far Is Too Far?

The idea of "runway" gets at one of the core questions on my mind throughout this whole thing: just how much stamina does America’s financial machinery have?

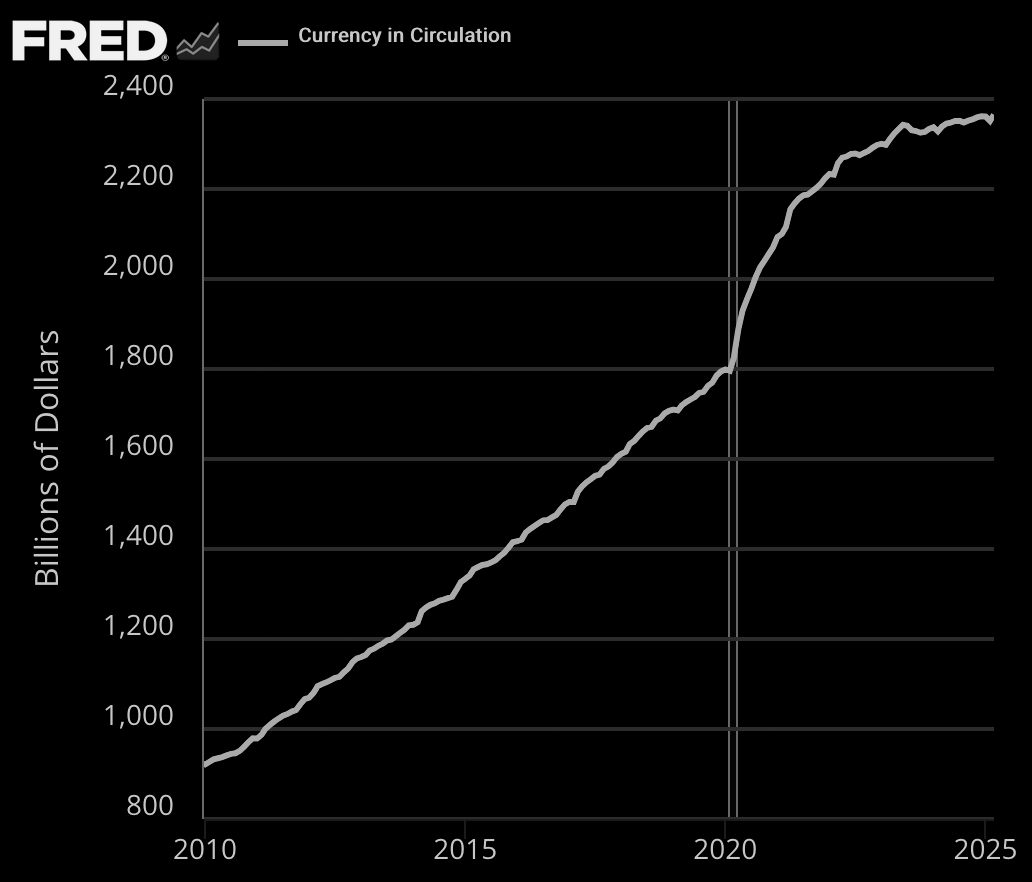

There have been numerous major events – the housing bubble, the entire QE period, the covid thing where we printed all that extra money – where things could have worsened in a much more real and lasting way, but were engineered away by various policy gymnastics that kept it so line still go up [5].

It is entirely reasonable to believe that we are due for some significant reckoning. I hesitate to use a word like “deserve”, but there are compelling arguments to be made that we’ve done quite a lot of fucking around and it makes sense that there would be some proportionally serious finding out as a result.

Yet it feels equally if not more compelling to propose that this will not happen in any lasting sense because “we don’t wanna”, and we live in the timeline where, against all odds and reason, that tactic actually fucking works.

I think it’s an absolutely monumental mistake to underestimate just how far the US will contort itself to keep this party going.

I’m old enough to have seen this a couple times. It’s an easy mistake to pull back too far, expecting a result that approximates fairness, only to miss out on enormous gains when it turns out that no, there’s just a quick slap on the wrist before the music starts up again, loud as ever.

In other words, how do we make the distinction between “this time is different” (rare) vs “this time should be different” (common). I do not have this answer, and as EG Ben Hunt’s efforts demonstrate, constructing a coherent and effective navigation framework can be multiple lifetimes' work for a pack much smarter than I.

I don’t think that solving that problem is a waste, per se; it’s valiant as hell. But for a fish my size, I think it risks being a serious distraction from some of the more actionable happenings discussed above.

V. Defense, Neutral, Offense

That's how I'm thinking about allocation as I prepare to sharply rebalance my portfolio for sharply changing times. I don't recommend large reactionary rebalancing – it just happens that I've been lazily positioned in some transparently stupid ways, have been correspondingly bloodied, and anticipate that the future will not improve. The math says I should pivot.

Defense (45%)

Safe, diversified, non-equity holdings. Hard assets, bonds, etc. I want to call out one kind of diversity in particular: response to *flation. Inflation, and increasingly, stagflation, have been our present and appear to be our future, but deflationary effects are still on the table, and there should be at least some attempt to shield from that.

Neutral (35%)

In short, "Vanguard". Generic index funds and “normal” shit. It’s market exposure, but it’s averaged across sane things and will rise and fall with the market at large. This is the part of my portfolio that honors “time in the market beats timing the market. I risk losses in the near term, but am along for the rebound as well.

Offense (20%)

This is the risky money. Only ever put here what you’re willing to lose in an instant. It is with this money that we act on the ideas expressed above. We use this money to look at the world and make predictions about the future. We never make an entrance without criteria for our exit.

Perhaps I use this to make some single stock holdings, on a thesis that might take years to fully realize. That’s fine. It might also be a 36 hour yolo play on some silly as-it-happens thing. That is also fine. For this money to work best, it must have no shame. It is “fuck yes or no”. It is full chested always, win or lose.

Barbell Strategy

The barbell strategy is an investment concept that suggests that the best way to strike a balance between reward and risk is to invest in the two extremes of high-risk and no-risk assets while avoiding middle-of-the-road choices.

– Barbell Strategy Explained

In my mind, the above allocations are a sort of barbell-lite. There's still a decent core of conventional equity exposure, but with a much bigger defensive shift than would otherwise be normal for my age and risk brackets. Plus a high-risk active fund that's about double what I'd normally aim for.

Is this a good idea? I have no fucking clue. Time will tell.

VI. Closing thoughts

Partway through writing this, I went outside. The sun is shining. Winter in Seattle is finally wearing off. There’s a lingering, private joy that comes from switching to my warm weather armor. It lets all the air rush in.

I rode to the Vietnamese place and ate bahn mi at the little canary yellow bistro table on the sidewalk. A passing saint bernard took great interest. I walked down the block to the corner store and left with a 6 pack, which I lashed to the pillion, with the back half of the sandwich, for the ride home.

It’s a very funny feeling to go numb in the face of all that crumbles and, about 6 minutes later, sit in the sun and watch the colors of a world that looks like Wes Anderson if he only shot Fuji.

Breathe the air. Count your blessings.

End.

[1] PLTR might be a relatively cheap buy. They’ve taken a solid haircut, but I don't think a Thiel affiliated next-gen defense contractor is likely to end this administration less rich.

[2] Notably, that experimentation is separate from the administration’s experimentation, as evidenced by just how much these tariffs are going to suck for Jeff Bezos.

[3] For me personally, I’m trying to remember that it is remarkably easy to be faster than 80% of the dumb money, and muster the bravery to do obviously stupid things with the confidence that I’m in the first quartile of the lemming herd. If those sound like famous last words, that's because they are.

[4] Here’s a silver lining that absolutely delights me: what if this leads to an American Shenzhen? That’s a post all its own, fantasizing about what that would look like. I’m not saying it’s possible, or even desirable. Rue the day your family is exposed to the labor practices that allow consumer electronics to cost what they do. But a world where one can shop that level of raw components domestically… that didn’t even exist in peak startup era San Francisco. It would unlock entire new categories of creativity and productivity.

[5] What I'm not saying is that all of those monetary policy gymnastics were illegitimate, ill advised, or had ill intent. That's well beyond the scope of this article. Here, it only matters that they all involved doing new and somewhat unusual things.